Quick links

Why invest in the Wacker Neuson Group?

Our strategy

Everything we do, think and learn is inspired by the success of our customers in the construction and agricultural sectors. We stay close to our customers around the world so we can react quicker and better to their needs.

Share

ISIN DE000WACK012 / WKN WACK01

On March 18, 2021, the Executive Board of Wacker Neuson SE resolved, with the approval of the Supervisory Board, to launch a share buyback program ("Share Buyback Program 2021") using the authorization granted by the company's Annual General Meeting on May 30, 2017. Under the Share Buyback Program 2021, a total of up to 2,454,900 treasury shares (corresponding to up to 3.5 percent of the Company's share capital) may be repurchased in a period from April 1, 2021 to April 30, 2022 at a total purchase price (excluding incidental acquisition costs) of a maximum of 53 million euros

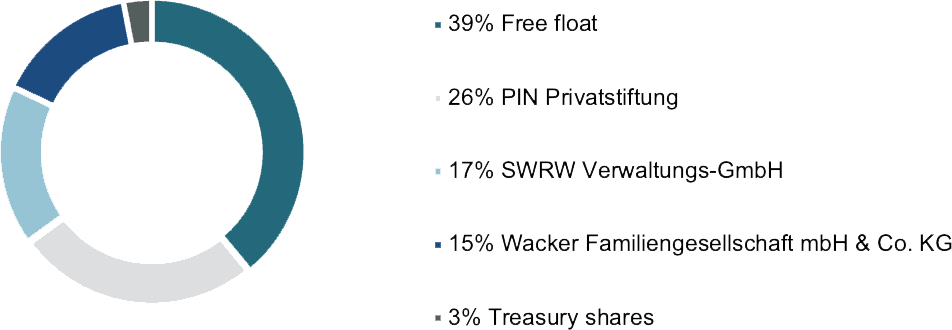

Shareholder structure

As of November 2025 – based on the latest publications in accordance with WpHG reporting requirements.

Rounding Differences. Total shares: 70,140,000.

* Various members of the Wacker Family hold separate stocks of the non-free float.

** The determination of non-free float and free float is based on the Guide to Equity Indices of Deutsche Börse AG.

E-mail: Voting-Rights@wackerneuson.com

ISIN | DE000WACK012 |

WKN | WACK01 |

| Stock exchange symbol | WAC |

| Branch | Industry |

| Share class | No-par-value registered shares (no-par-value shares) |

| Share capital | 70,140,000 Euro |

| Number of authorized shares | 70,140,000 shares |

| Corporate actions | 2,437,088 new shares (capital increase through contributions in kind, Oct. 25, 2007) |

| 16,702,912 new shares (capital increase through contributions in kind, October 2, 2007) |

| Date of IPO | May 15, 2007 |

| Emission method | Bookbuilding procedure |

| Bookbuilding spread | 18.00–22.00 Euro |

| Issue price | 22.00 Euro |

| First prize | 24.60 Euro |

| Stock exchange segment | Official Market (Prime Standard) Frankfurt Stock Exchange |

| Consortium | Global Coordinators & Joint Bookrunners: Deutsche Bank; Sal. Oppenheim jr. & Cie. KGaA; UBS Investment Bank |

| Placement volume excl. greenshoe | 351,980,000.00 Euro |

| Placement volume in units excl. greenshoe | 15,999,117 |

| Placement volume incl. greenshoe | 404,780,000.00 Euro |

| Available greenshoe in pieces | 2,399,868 |

| Share capital in units at initial listing | 51,000,000 |

| Total market capitalization at initial listing | 1,254,600,000.00 Euro |

| Market capitalization Free float at initial listing | 452,910,000.00 Euro |

| Free float at initial listing | 36.10 % |

Designated Sponsor | M.M.Warburg |

| Paying office | Deutsche Bank AG, Taunusanlage 12, 60325 Frankfurt am Main, Germany |

Wacker Neuson SE is monitored by financial analysts who regularly publish their own reports on our company. On this website, we provide you with the latest consensus determined by Vara Research for information purposes only. This consensus is based solely on the analyses of these financial analysts, who are independent of Wacker Neuson SE. The contents of this page are in no way intended to provide investment advice. The views, forecasts, estimates and predictions expressed by the analysts are theirs alone and do not represent the views, forecasts, estimates and predictions of Wacker Neuson SE or the Executive Board of Wacker Neuson SE. Wacker Neuson SE therefore assumes no liability whatsoever with regard to the correctness, accuracy or completeness of these assessments and undertakes no obligation to update or revise them, even if they deviate from its own forecasts or expectations.

Our share is the focus of numerous analysts. The following overview of recommendations on the Wacker Neuson SE share is provided for your information on the basis of an authorization from the respective analyst. This list does not claim to be complete. If you have any questions regarding the individual studies, please contact the analyst in question.

| Recommendation | Date | |

|---|---|---|

| B. Metzler seel. Sohn & Co. Analyst: Stephan Bauer | Hold, Target price 22.00 Euro | October 15, 2025 |

| Jefferies Analyst: Martin Comtesse | Hold, Target price 21.00 Euro | February 10, 2026 |

| Kepler Cheuvreux Analyst: H.J. Heimbürger | Reduce, Target price 19.00 Euro | February 12, 2026 |

| Warburg Research / Münchmeyer Petersen Capital Markets Analyst: Stefan Augustin | Hold, Target price 24.00 Euro | February 11, 2026 |

Note: The assessments and recommendations on this website do not constitute a solicitation to buy, hold or sell securities and do not represent an advertisement for securities. The views, predictions, estimates and forecasts represented by the analysts with regard to the design and development of the Wacker Neuson SE stock only reflect the opinions of these analysts. Wacker Neuson SE assumes no liability for the accuracy and/or completeness, selection and timeliness of the representation.

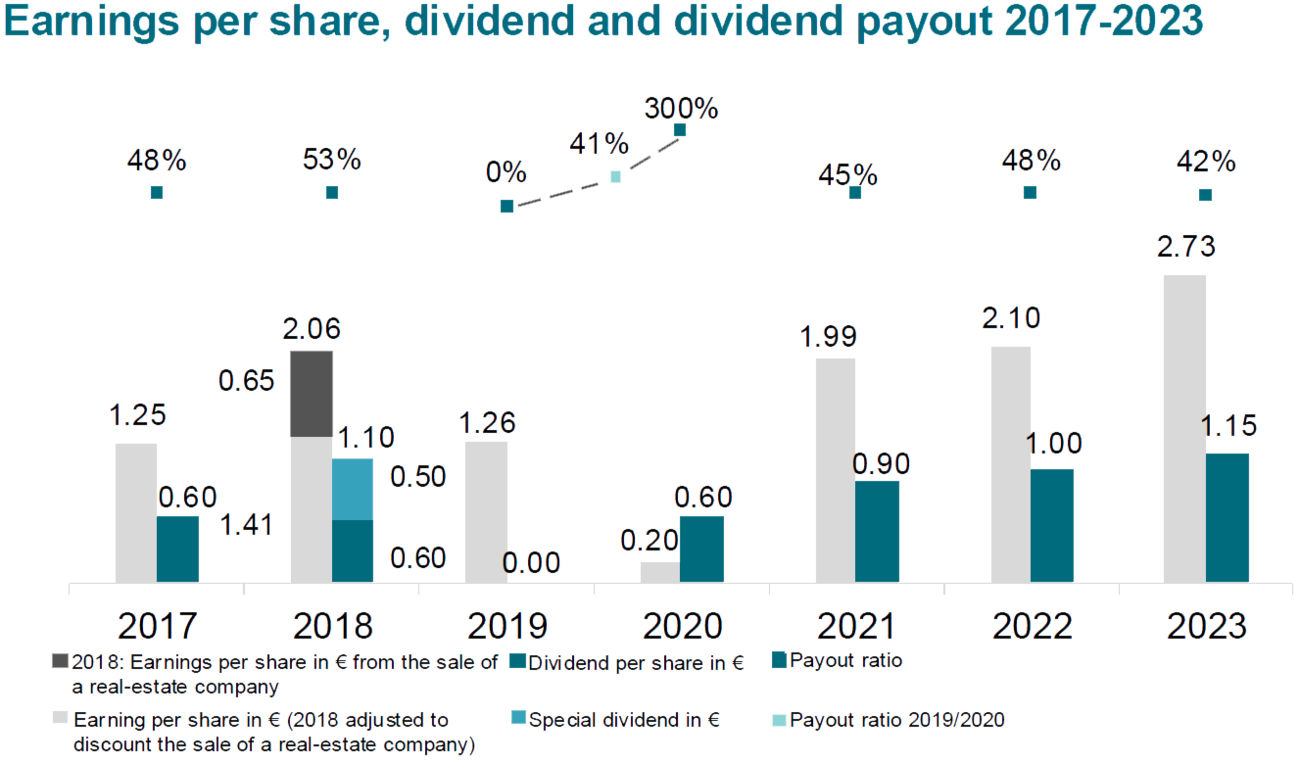

Dividend policy:

Wacker Neuson SE has adopted an attractive shareholder remuneration policy to ensure that shareholders enjoy a steady and appropriate share of the company’s profit. This framework is determined by the earnings figures and the need to ensure that the Wacker Neuson Group maintains adequate capitalization.

The Wacker Neuson SE dividend policy provides for a payout per share of 40 to 60 percent of Group earnings per share.

This dividend policy reflects the current objective of the Executive Board and the Supervisory Board and it may be modified in the future. In addition, corresponding dividend proposals from the Executive Board and the Supervisory Board are required for the payment of a dividend in a given year, and both of these bodies could decide to depart from this dividend policy if they see fit under the prevailing circumstances. The decision on the dividend is made by the AGM.

The Annual General Meeting approved the proposal of the Executive Board and Supervisory Board to pay out a dividend of EUR 1.15 per eligible share after the successful fiscal year 2023.

Dividend history:

- Continuity in paying attractive dividends

- Dividend yield of 6.3% based on XETRA closing price in 2023

Financial reports and presentations

Select several documents for a collective download by clicking the box.

Q3/2025 Report: Here you will find the recording of the Q3/2025 Earnings Call

Strategy 2030: Here you will find the recording of the Management Call, Strategy 2030

Non-financial Group reports

Corporate Governance

Supervisory Board

The Wacker Neuson Group Supervisory Board has six members: Hans Neunteufel, Prof. Dr. Matthias Schüppen, Peter Riegler, Ralph Wacker, Elvis Schwarzmair, Christian Kekelj.

Executive Board team

Wacker Neuson SE is a European company (Societas Europaea) with its headquarters in Munich. The four members of its Executive Board team are Dr. Karl Tragl, Felix Bietenbeck, Christoph Burkhard and Alexander Greschner.

Dealing with risks responsibly and with discernment is among the primary tasks of good corporate governance. Through a systematic risk management, we ensure that risks are detected promptly and the potential for risks is minimized. This system is continuously developed and adapted to the respective boundary conditions.

The risk management system is shown in the Wacker Neuson Group’s annual report.

Remuneration system for the members of the Executive Board

Taking into account the Act Implementing the Second Shareholders’ Rights Directive (“ARUG II”) and the German Corporate Governance Code (“DCGK”) in the version of April 28, 2022, the Supervisory Board has resolved changes to the remuneration system for the members of the Executive Board with effect from January 1, 2025 and submitted the remuneration system to the Annual General Meeting on May 23, 2025 for approval (item 8 of the agenda). The Annual General Meeting has approved the remuneration system for the members of the Executive Board with a majority of 95.14%.

Remuneration system for the members of the Supervisory Board

On May 23, 2025, the Annual General Meeting adopted a remuneration system for the members of the Supervisory Board prepared in accordance with the Act Implementing the Second Shareholders’ Rights Directive (“ARUG II”) and the German Corporate Governance Code (“DCGK”) in the version of April 28, 2022 under agenda item 9 with a majority of 88.99%.

Notifications about transactions of directors according to para. 19 market abuse regulation (EU) Nr. 596/2014:

Notifications about transactions by persons with managerial responsibilities in accordance with para. 19 market abuse regulation (EU) No 596/2014 are listed below. People with managerial responsibilities include members of a managerial, administrative or supervisory body, as well as other persons who have regular access to insider information. The transactions listed only affect the no-par shares of Wacker Neuson SE (formerly Wacker Construction Equipment AG), ISIN DE000WACK012.

The following transactions were reported to Wacker Neuson SE (since July 3, 2016 pursuant to Art. 19 MAR, previously pursuant to § 15a Securities Trading Act):

Corporate Governance Downloads

The documents above are non-binding English translations of the German originals.

AGM

The ordinary Annual General Meeting of Wacker Neuson SE will take place on May 23, 2025 at Haus der Bayerischen Wirtschaft (hbw Conference Center), Max-Joseph-Straße 5, 80333 Munich, Germany.

Click here for the password-protected internet service (in German):

Downloads for AGM

Financial calendar

Please send your voting rights notifications in case of crossing thresholds to: Voting-Rights@wackerneuson.com

Investor Relations Distribution List

To be included in the Investor Relations distribution list, please fill out the form.